Credit: K KStock/Adobe stock

Credit: K KStock/Adobe stock

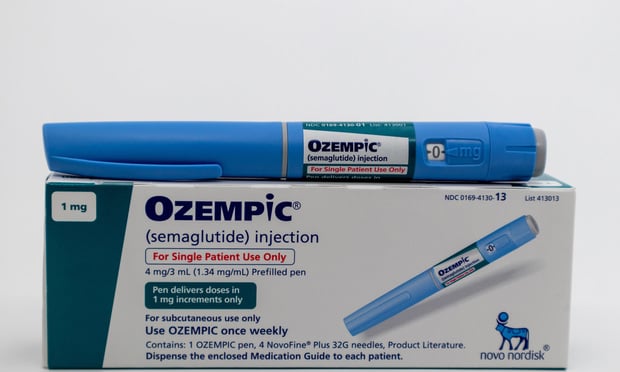

There has been a meteoric rise in popularity of the class of drugs commonly known as GLP-1s—including name brand drugs such as Ozempic and Wegovy. In addition, some plan sponsors have experienced a staggering increase in plan costs as a result of these drugs, which can run well over $1,000 per month. Initially approved to help diabetes patients control their blood sugar, drugs such as Ozempic have soared in popularity in recent years, in large part due to their popular side effect of rapid weight loss. Social media attention and popular culture references have fueled the rising awareness.

Many plans have long excluded weight-loss medications, and others have recently added or considered adding exclusions when these high-cost medications are prescribed for weight loss instead of diabetes. Recently, however, a more measured approach is starting to take shape around whether to cover GLP-1s—formally, glucagon-like peptide agonists—for weight loss, with plan sponsors balancing the near-term financial impacts of covering the drugs with the long term plan and productivity costs of untreated obesity, arising from comorbidities such as cardiometabolic and musculoskeletal disorders. More and more employers are considering covering these drugs when prescribed for weight loss, while implementing certain "guardrails" to manage cost and improve health outcomes—for example:

- Requiring prior authorization to ensure that GLP-1s are a clinically appropriate treatment.

- Requiring step therapy, so that alternative lower-cost weight loss treatments must be tried first.

- Pairing access to GLP-1s with behavior modification programs to improve long-term success in keeping weight off.

- Narrowing the provider network through which participants can access GLP-1s.

- Exploring imposing lifetime or annual dollar limits on coverage of these drugs when prescribed for weight loss.

However, before making these types of changes, there are steps employers can take to prevent administrative complications and legal problems down the road:

- Ask whether the plan's pharmacy benefit manager or third-party administrator has well-developed clinical guidelines that can be applied to claims for weight loss medications. This may include coverage of certain medications and not others, or coverage only within certain parameters, such as a clinical diagnosis of obesity or related health problems.

- Alternatively, if in the future Medicare begins covering weight loss drugs, future Medicare guidelines might be helpful for administration of these claims.

- Consider whether certain medications are currently in short supply or are likely to be subject to shortages in the foreseeable future.

- Consider whether there are any ongoing claims or appeals by participants over coverage of weight loss medications and how any recently denied claims would be treated under new plan guidelines.

- Review claims data for any recent increases in diabetes medication claims for participants with no prior history of diabetes. This may be an indication of off-label prescribing and use that should not be allowed under current plan rules.

When it comes to deciding what prescription drug benefits are covered and under what circumstances, the Employee Retirement Income Security Act of 1974 ("ERISA") allows employers a fair amount of discretion. This is particularly true in the self-funded health plan market. There, plan sponsors have broad latitude to design their plans to fit the unique needs of their employee populations, benefit philosophies, and financial constraints. When making any changes to health plan coverage of GLP-1s (or other benefits), some compliance items should be kept in mind:

Recommended For You

Related: GLP-1 revolution: What it means for employer-sponsored plans

- ERISA requires that a plan must be administered in accordance with its written terms, so if an employer's health plan document is detailed enough to address the conditions of coverage of these drugs, a plan amendment will be needed to implement any changes to that coverage.

- Material changes to the plan's coverage must be communicated to participants within certain timeframes:

- Generally, participants must be notified of a material change in plan terms within 210 days after the end of the plan year in which the change is adopted; however, it is often advisable to give notice of changes much sooner.

- If the plan sponsor implements a change that is a reduction in benefits—for example, excluding coverage of GLP-1 drugs for weight loss altogether, or imposing new conditions on accessing benefits—notice of those changes must be given within 60 days after the change is adopted.

- If the change would affect the content of the plan's summary of benefits and coverage (SBC), notice of the change must be provided to participants at least 60 days before the change becomes effective.

- The Affordable Care Act prohibits health plans from imposing annual or lifetime dollar limits on the value of "essential health benefits," so employers who wish to explore doing so must first determine that these drugs are not essential health benefits under the plan's definition of that term.

Ultimately, whether or not to cover GLP-1s when prescribed for weight loss, and under what conditions, is a decision to be made by each plan sponsor, after careful consideration of the short-term and long-term costs, participant demand, and other considerations.

Kristine Bingman is a shareholder in the Portland, OR office of Ogletree Deakins. Kristine's practice focuses on health and welfare plan compliance. She advises clients on all aspects of ERISA and Internal Revenue Code compliance as it relates to health and welfare plans.

Timothy Stanton is a shareholder in the Chicago office of Ogletree Deakins. Tim focuses his practice on employee benefits, specifically Affordable Care Act compliance, data privacy and security, and benefit plan administration.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.