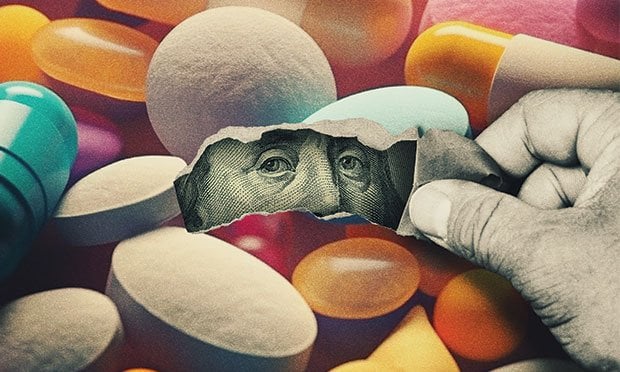

Pharmacy benefit managers (PBMs) have recently come under fire as Congress works to lower prescription drug costs in the United States. While prescription drugs often get blamed for high premiums and costs, one industry report found that for every dollar, 11 cents is spent on brand-name medicines – while up to 20 cents is going toward administrative costs.

Healthcare entities see significant profits from their PBM subsidiaries via their mail-order and specialty pharmacies and clinical programs. This system will keep many of these companies in the Fortune 50 while prescriptions become increasingly expensive for employers and patients. There's a reason the major insurance companies and PBMs are now combined entities: There's big money in working the system to their own benefit.

Recommended For You

All of this leaves employers and their members at a loss. Satisfaction with PBMs is now at a 9-year low, while overall Net Promoter Scores (NPS) of PBMs have dropped 30 points in the last two years. Meanwhile, the out-of-pocket cost of drugs continues to climb for patients (even taking into account the use of drug manufacturer coupons and discount cards), due to the increasing costs of drugs and continued movement to high deductible benefit design.

This is all coming at a fraught time for employers, when some may be questioning their pharmacy benefits decisions in light of a new J&J lawsuit brought by an employee. The question – "are we making the right decisions on prescription drugs for our employees" has many unknowns without transparency around PBM contract language and excessive fees. The brokers and consultants who align with legacy PBMs also may push traditional rebate-focused models that don't necessarily drive the lowest net cost to the member – and may actually pad the PBM's bottom line through practices like favoring prescriptions with rebates. So, while spend goes up and questions from employees arise, employers don't have what they need to determine whether they are making sound decisions.

But, in light of the opportunities that may be coming in unbundling PBM services, employers have an opportunity to make a change. Here are six red flags – and what to look for in a new solution.

1. Red flag: Member engagement isn't a priority.

According to recent data, about 1 in 5 people say they have not filled a prescription because of the cost. Though the reasons for this are complicated, many PBMs may not be prioritizing the member behavior shifts that could drive down costs for both the plan and the member, including an easy shopping experience (since prices can vary at pharmacies), offering the member the option of paying in cash vs. using insurance, helping the member understand there's a lower-cost alternative at the point of care, and more.

How to change it: Look for pharmacy benefits that prioritize member engagement through new technologies that help members make choices around their prescriptions. Ask potential partners – what is the member experience? Is it easy to use? Do members understand their options at the point of prescribing? What do members say? By empowering members, employers can help impact costs for not just the plan but also the member, which is key to driving down healthcare costs as a whole.

2. Red flag: Unclear administrative fees while pharmacy spend goes up.

The big PBMs' fee compensation doubled from 2018 to 2022, thanks to the inclusion of new data and data portal fees that have grown from near zero to nearly $1 billion in 2022. In addition, PBM contracting entity fees (so-called "vendor fees") have gone from near zero to $760 million. According to a Nephron Research report, entity fees are a clear indication that PBMs have "systematically shifted fees from PBMs to PBM contracting entities which add additional layers to the system." Even if your admin fees remain flat, consider this: Is your pharmacy spend going up? It could all be connected, but without transparency, it's hard to know.

How to change it: When evaluating a new pharmacy benefits partner, ask directly: What do you mean by "transparent"? There are levels of transparency and asking this question as a baseline can help you gain perspective. Also look for a PBM that offers a clear, transparent fee schedule that prioritizes employer savings and value, and ask specifically about vendor fees, data portal fees and, if included, be sure you know exactly how you benefit from those services.

3. Red flag: Prioritizing rebates.

From 2018 to 2022, PBM compensation from manufacturer rebates increased 64%, earning them $25 billion in additional revenue, far exceeding commercial brand sales growth of 39%. There's a clear incentive for PBMs to favor preferred products in their formularies that offer the highest potential income from manufacturer's rebates, only a small portion of which ever get passed on to plan sponsors. Unfortunately, many companies depend on that rebate check at the end of the year. But the reality is they've spent far more than that to get it.

How to change it: The solution here is two-fold. First, companies have to break from reliance on rebates and instead focus on a lowest net cost strategy. Second, demand that PBM partners provide transparent information around the portion of rebates being passed on to the employer vs what the PBM keeps and a comparison between real-time cost savings from alternative medications.

4. Red flag: Relaxing prior authorization requirements.

Pharmaceutical breakthroughs happen every day, and new drugs, like GLP-1s, can be life changing—and lifesaving—for patients. But not everyone is a good candidate for the latest and greatest medications, and prior authorization processes exist to help providers evaluate the necessity and value of prescribing specific drugs for each individual.

Yet when PBMs own their own pharmacy, there may be an incentive for them to offer the latest, most expensive (and most profitable) drugs to patients, and they might be willing to relax the criteria required to prescribe. These simplified prior authorization processes might be just 3-4 questions, which result in overprescribing of high-cost drugs when there could be less expensive, biosimilar medications.

How to change it: Plan sponsors should look for a PBM that offers a reasonable, fiscally and medically sound prior authorization process that prioritizes robust patient screening, patient needs and cost-benefit analysis to avoid putting people on expensive drugs over lower-priced alternatives.

5. Red flag: Restricted audit rights.

>PBM contracts often include audit rights that give plan sponsors the ability to review rebates and manufacturer administration fees, along with price protection data. But if your PBM limits your ability to audit only certain parts of the contract, that's a big red flag.

How to change it: Find a PBM that offers complete audit rights that include an audit of network and rebate contracts. A true partner will prioritize transparency and be willing to show you exactly the cost savings and health benefits they're delivering for you and your subscribers.

6. Red flag: Lack of detailed reporting.

PBM reports can leave sponsors in the dark about what they're really getting, showing aggregate data on rebates based on the total volume of claims and approvals vs. denials and sometimes refusing to provide employers detailed information on their own claims. But there's so much more data hidden under the disbursement report from manufacturers.

How to change it: A transparent PBM should be showing claim-level data against rebates and for approvals and denials – really, on all claims. As long as the data is anonymized, it is no longer HIPAA-protected, so don't let your PBM off the hook. It's your right as a plan sponsor to know exactly what you should be getting and the claim-level savings, so insist that your contract provides for this transparency.

After years of self-serving control by PBMs, it's time for employers to demand transparency from PBMs and empower their members to make better-informed decisions that prioritize health outcomes and value—an arrangement that's entirely feasible while still allowing for a fair and reasonable profit.

Rae McMahan is SVP, Payer Solutions for Prescryptive Health.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.