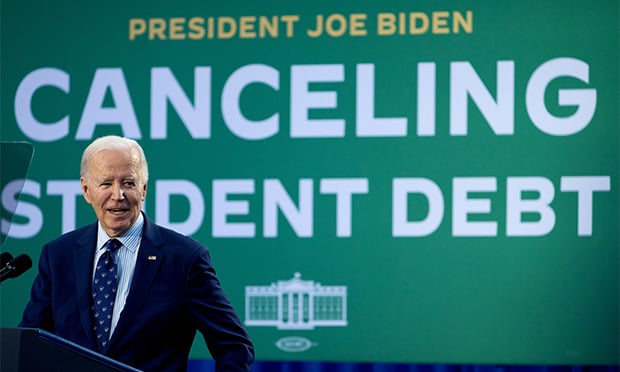

Despite his two previous unsuccessful attempts to cancel student loans on a grand scale, President Joe Biden is moving ahead with a new plan to forgive student loans with a proposed new rule that would authorize forgiveness for eight million borrowers facing "hardship."

Despite his two previous unsuccessful attempts to cancel student loans on a grand scale, President Joe Biden is moving ahead with a new plan to forgive student loans with a proposed new rule that would authorize forgiveness for eight million borrowers facing "hardship."

Under the new plan, the Education Department can discharge debt if it calculates a borrower has an 80% likelihood of defaulting on payments within two years based on 17 factors, including income, debt balances and assets.

Biden's first attempt at student loan forgiveness was axed by the Supreme Court on June 30, 2023. Hours later, the president announced the $475 billion Saving on a Valuable Education (SAVE) plan, which has been tied in federal courts for months and is now on hold, after a federal judge in Missouri blocked the plan earlier this month, just one day after a judge in Georgia gave approval to go forward. The states argued that the SAVE plan, which the administration had wanted to start implementing this fall ahead of the presidential election, is illegal.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking benefits news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.