Filter this View

- Benefits Broker

- Benefits Manager

- Retirement Advisor

- Awards

- Broker Expo

- FreeERISA

- Leads

- Career Center

- More

NOT FOR REPRINT

Page Printed from: benefitspro.com/search/?Submit=Search&page=2&q=us%20securities%20and%20exchange%20commission

Search Results

507 results for us securities and exchange commission

Resources

Optavise

From Optavise

Download this white paper to explore how voluntary benefits serve as crucial risk management tools for employers, mitigating the financial burden of workers’ compensation.

Download Resource

LifeSecure Insurance Company

From LifeSecure Insurance Company

Employers are revamping their benefits strategies--but are they offering what employees truly want? Discover the seven key elements shaping workplace benefits in 2025 to help your clients enhance satisfaction, retention, and enrollment.

Download Resource

Nonstop Administration and Insurance Services, Inc.

From Nonstop Administration and Insurance Services, Inc.

In 2025, you are uniquely positioned to make a real difference for your clients--both financially and in the wellness of their employees. Full of tips ranging from goal setting to relationship building, this is your guide to being a better partner this year, and beyond.

Download Resource

Nonstop Administration and Insurance Services, Inc.

From Nonstop Administration and Insurance Services, Inc.

Explore alternative plan designs, including HSAs, HRAs, QSEHRAs, ICHRAs, and MERPs, in this brief e-book.

Download Resource

Nonstop Administration and Insurance Services, Inc.

From Nonstop Administration and Insurance Services, Inc.

Discover innovative solutions to help your clients overcome cost barriers in health insurance.

Download Resource

Nonstop Administration and Insurance Services, Inc.

From Nonstop Administration and Insurance Services, Inc.

Prioritizing health equity can transform your sales strategy and secure long-term business success. This guide helps you lead thoughtful conversations by aligning with employers' values.

Download Resource

Nonstop Administration and Insurance Services, Inc.

From Nonstop Administration and Insurance Services, Inc.

You can bet that many of your employer clients will be considering alternative funding models as they shop around for health plans this year. Download this short guide to learn about the difference between MERPs and HRAs, why they matter and how you can provide your clients with lower costs, more flexibility and greater satisfaction.

Download Resource

Zelis

From Zelis

Managing health plan data is complex and time-consuming. Brokers need seamless access to accurate, up-to-date provider and network information to effectively guide employers and beneficiaries. This resource explores how to streamline workflows, reduce manual data handling, and enhance decision-making with smarter solutions.

Download Resource

ArmadaCare

From ArmadaCare

Are HDHPs & HSAs really the best solution? Let’s take a closer look.

Download Resource

Nova Healthcare Administrators, Inc.

From Nova Healthcare Administrators, Inc.

Healthcare costs are rising, and self-funded employers need a smarter approach. Discover how medical management can enhance cost efficiency and care quality. Download now to explore proven strategies and real-world success stories.

Download Resource

Nova Healthcare Administrators, Inc.

From Nova Healthcare Administrators, Inc.

Open enrollment is your chance to shine as a strategic partner. This guide equips benefit advisors with 5 actionable tips to help clients reduce confusion, streamline processes, and deliver exceptional value to their employees.

Download Resource

Nonstop Administration and Insurance Services, Inc.

From Nonstop Administration and Insurance Services, Inc.

Four industries, one health plan that delivers real savings and better benefits. See how a nonprofit, a wholesale distributor, a health center, and a school district reduced costs and eliminated copays and deductibles--without taking on additional risk. Download the case study bundle to explore how first-dollar coverage can make a difference for your clients.

Download Resource

ArmadaCare

From ArmadaCare

Help your clients make informed decisions about executive medical reimbursement plans while ensuring compliance amidst evolving regulations.

Download Resource

New Benefits

From New Benefits

Explore four strategies that benefits advisors can leverage to help their clients reduce healthcare expenses.

Download Resource

Nova Healthcare Administrators, Inc.

From Nova Healthcare Administrators, Inc.

Guiding your clients to the right network solution is vital for balancing costs, access, and employee satisfaction. Use this eBook as a strategic and educational tool to provide clarity for your clients around the ins and outs of network solutions.

Download Resource

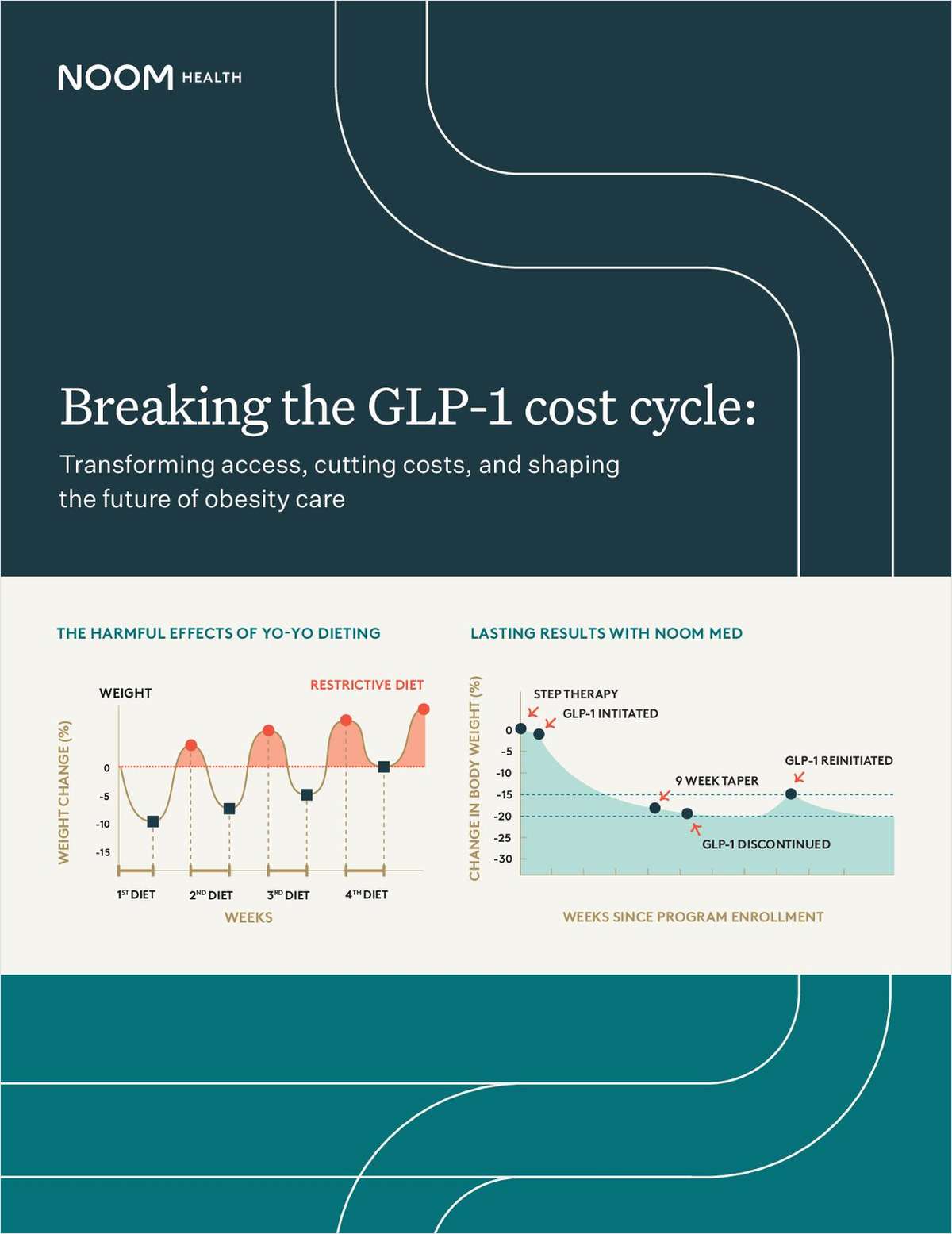

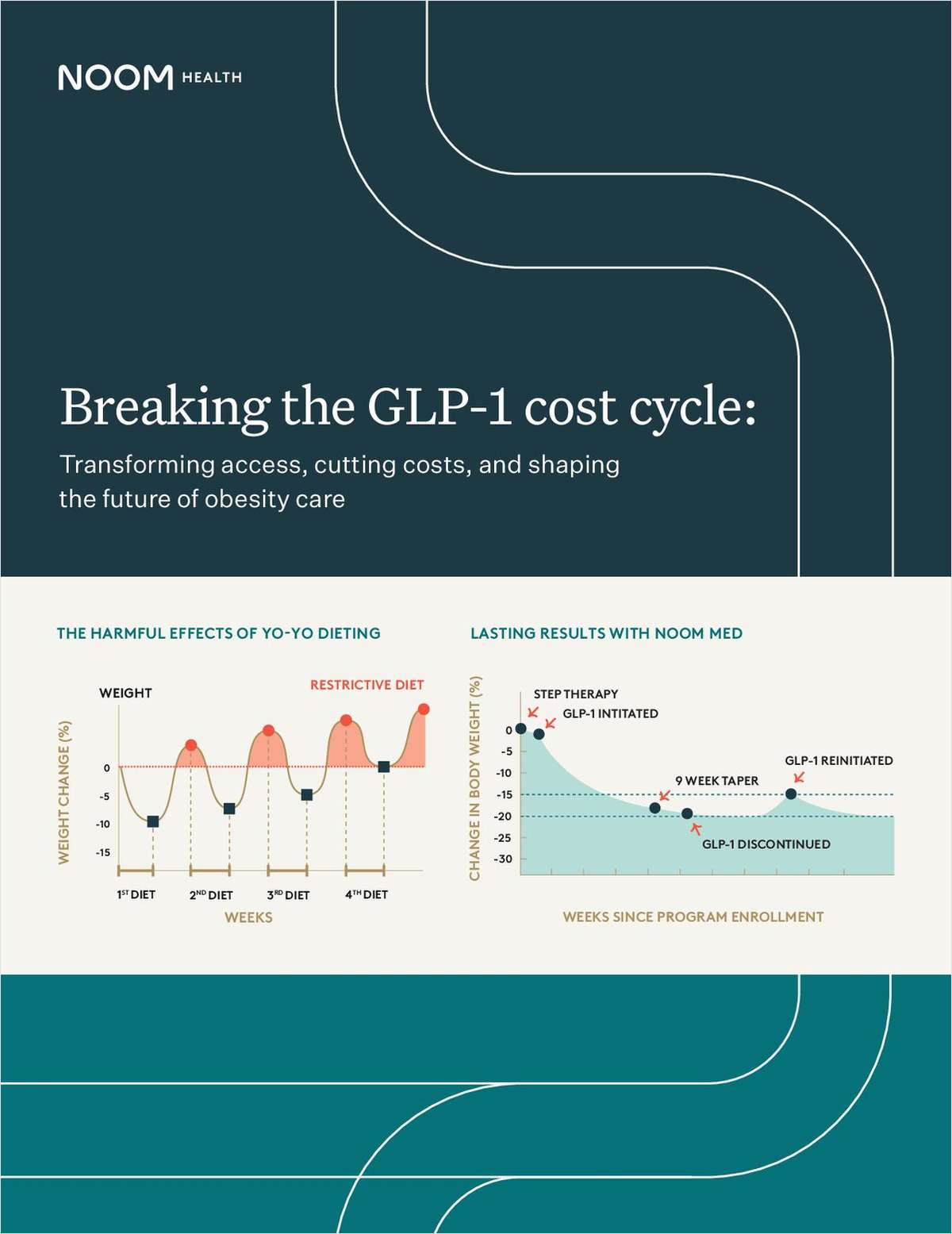

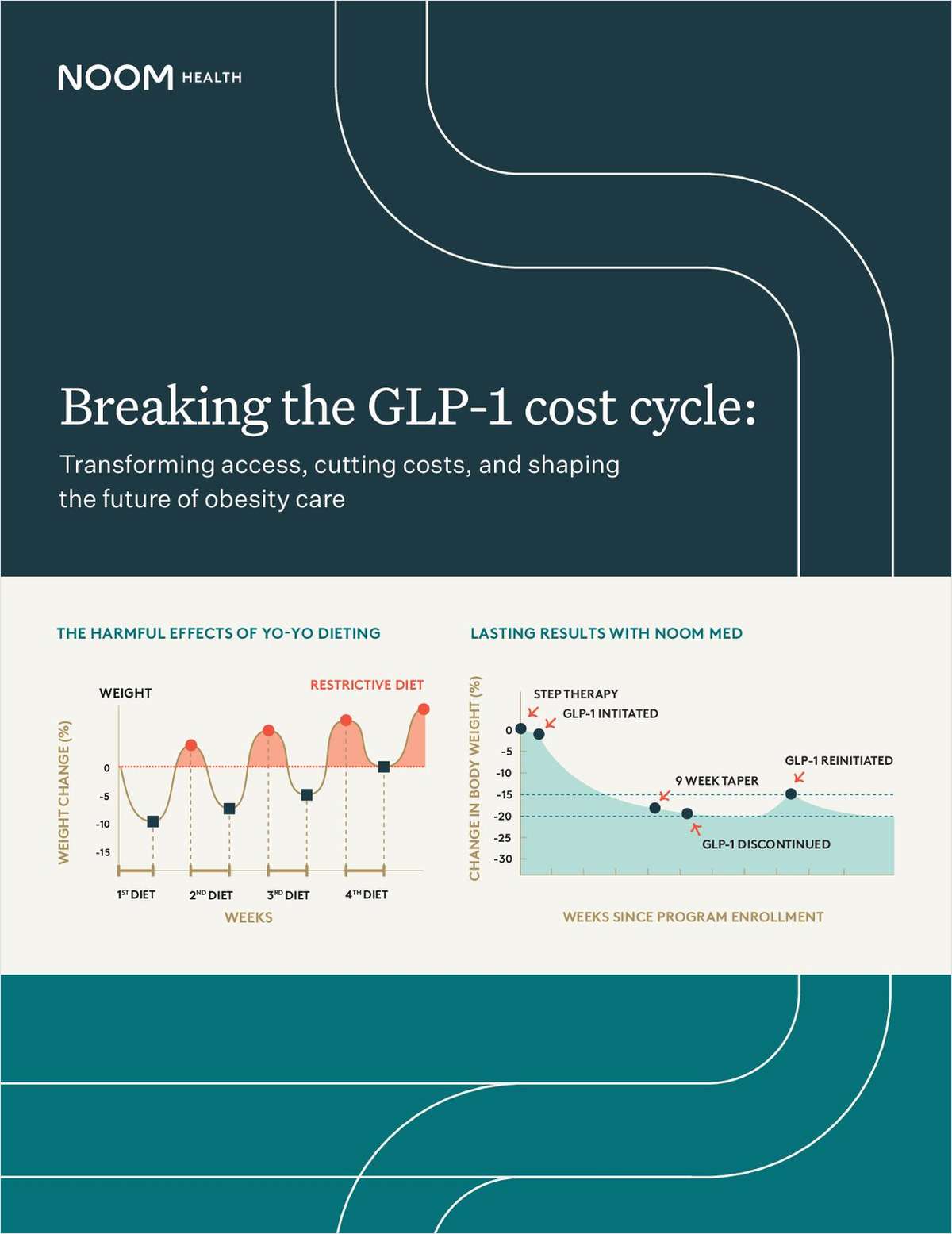

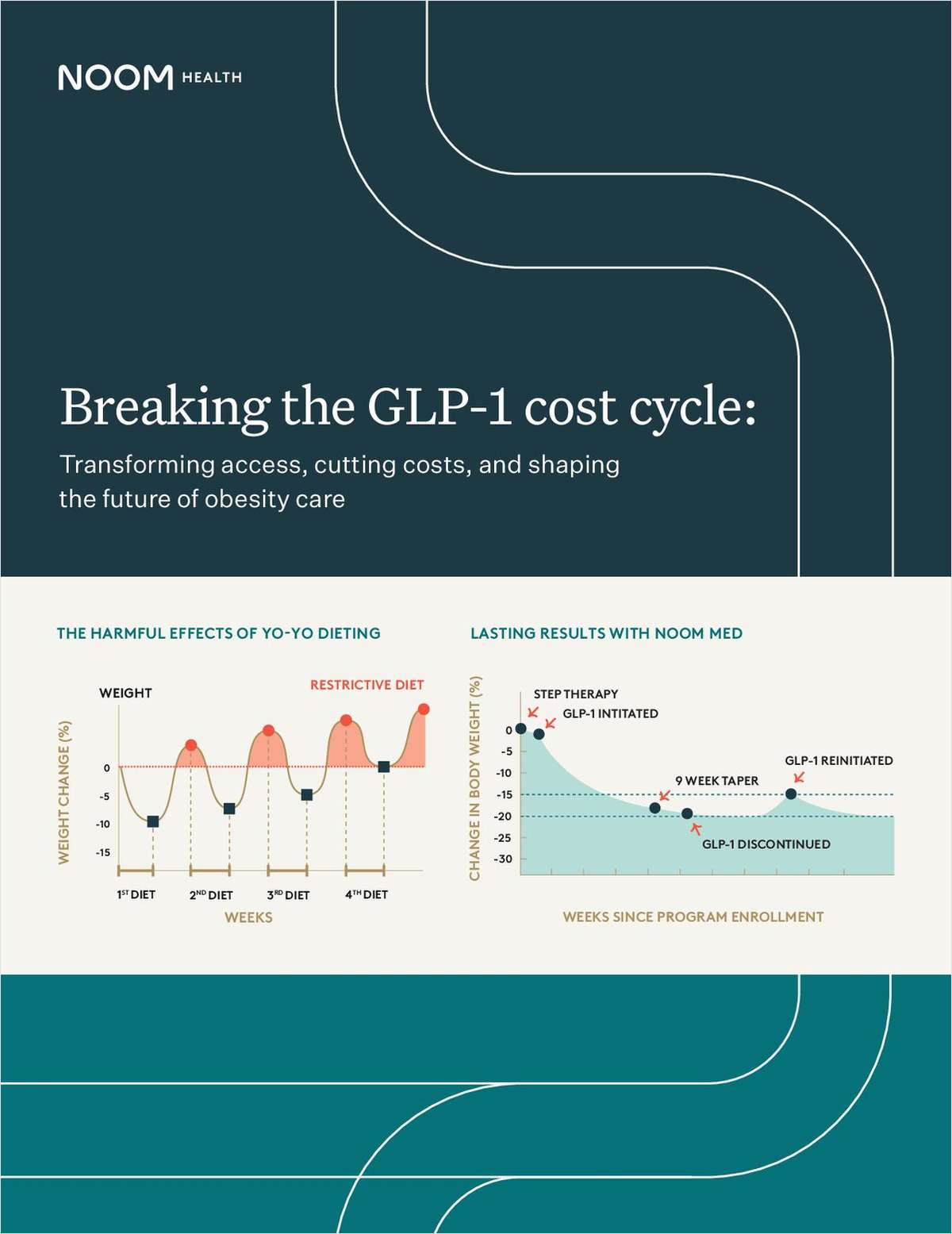

Noom Health

From Noom Health

As obesity rates rise, GLP-1 medications are gaining popularity. Yet, the multifactorial obesity epidemic presents challenges for your clients as more of their employees demand GLP-1’s. This white paper explores strategies to help clients cut costs, improve employee health outcomes, and achieve a measurable ROI.

Download Resource

New Benefits

From New Benefits

This report reveals the top non-insured benefits that not only reduce costs but also address the rising challenges of burnout, financial stress, and work-life balance. Give your clients the edge they need to support their employees while driving business growth. Download the report now to learn more!

Download Resource

Noom Health

From Noom Health

As obesity rates rise, GLP-1 medications are gaining popularity. Yet, the multifactorial obesity epidemic presents challenges for organizations as more employees seek GLP-1’s. This white paper explores actionable strategies to help cut costs, improve employee health outcomes, and achieve a measurable ROI.

Download Resource

ArmadaCare

From ArmadaCare

Are brokers prepared for what’s next? See the 5 hot benefits trends shaping 2025 in this report.

Download Resource

Optavise

From Optavise

Download this white paper to explore how voluntary benefits serve as crucial risk management tools for employers, mitigating the financial burden of workers’ compensation.

Download Resource

LifeSecure Insurance Company

From LifeSecure Insurance Company

Employers are revamping their benefits strategies--but are they offering what employees truly want? Discover the seven key elements shaping workplace benefits in 2025 to help your clients enhance satisfaction, retention, and enrollment.

Download Resource

Nonstop Administration and Insurance Services, Inc.

From Nonstop Administration and Insurance Services, Inc.

In 2025, you are uniquely positioned to make a real difference for your clients--both financially and in the wellness of their employees. Full of tips ranging from goal setting to relationship building, this is your guide to being a better partner this year, and beyond.

Download Resource

Nonstop Administration and Insurance Services, Inc.

From Nonstop Administration and Insurance Services, Inc.

Explore alternative plan designs, including HSAs, HRAs, QSEHRAs, ICHRAs, and MERPs, in this brief e-book.

Download Resource

Nonstop Administration and Insurance Services, Inc.

From Nonstop Administration and Insurance Services, Inc.

Discover innovative solutions to help your clients overcome cost barriers in health insurance.

Download Resource

Nonstop Administration and Insurance Services, Inc.

From Nonstop Administration and Insurance Services, Inc.

Prioritizing health equity can transform your sales strategy and secure long-term business success. This guide helps you lead thoughtful conversations by aligning with employers' values.

Download Resource

Nonstop Administration and Insurance Services, Inc.

From Nonstop Administration and Insurance Services, Inc.

You can bet that many of your employer clients will be considering alternative funding models as they shop around for health plans this year. Download this short guide to learn about the difference between MERPs and HRAs, why they matter and how you can provide your clients with lower costs, more flexibility and greater satisfaction.

Download Resource

Zelis

From Zelis

Managing health plan data is complex and time-consuming. Brokers need seamless access to accurate, up-to-date provider and network information to effectively guide employers and beneficiaries. This resource explores how to streamline workflows, reduce manual data handling, and enhance decision-making with smarter solutions.

Download Resource

ArmadaCare

From ArmadaCare

Are HDHPs & HSAs really the best solution? Let’s take a closer look.

Download Resource

Nova Healthcare Administrators, Inc.

From Nova Healthcare Administrators, Inc.

Healthcare costs are rising, and self-funded employers need a smarter approach. Discover how medical management can enhance cost efficiency and care quality. Download now to explore proven strategies and real-world success stories.

Download Resource

Nova Healthcare Administrators, Inc.

From Nova Healthcare Administrators, Inc.

Open enrollment is your chance to shine as a strategic partner. This guide equips benefit advisors with 5 actionable tips to help clients reduce confusion, streamline processes, and deliver exceptional value to their employees.

Download Resource

Nonstop Administration and Insurance Services, Inc.

From Nonstop Administration and Insurance Services, Inc.

Four industries, one health plan that delivers real savings and better benefits. See how a nonprofit, a wholesale distributor, a health center, and a school district reduced costs and eliminated copays and deductibles--without taking on additional risk. Download the case study bundle to explore how first-dollar coverage can make a difference for your clients.

Download Resource

ArmadaCare

From ArmadaCare

Help your clients make informed decisions about executive medical reimbursement plans while ensuring compliance amidst evolving regulations.

Download Resource

New Benefits

From New Benefits

Explore four strategies that benefits advisors can leverage to help their clients reduce healthcare expenses.

Download Resource

Nova Healthcare Administrators, Inc.

From Nova Healthcare Administrators, Inc.

Guiding your clients to the right network solution is vital for balancing costs, access, and employee satisfaction. Use this eBook as a strategic and educational tool to provide clarity for your clients around the ins and outs of network solutions.

Download Resource

Noom Health

From Noom Health

As obesity rates rise, GLP-1 medications are gaining popularity. Yet, the multifactorial obesity epidemic presents challenges for your clients as more of their employees demand GLP-1’s. This white paper explores strategies to help clients cut costs, improve employee health outcomes, and achieve a measurable ROI.

Download Resource

New Benefits

From New Benefits

This report reveals the top non-insured benefits that not only reduce costs but also address the rising challenges of burnout, financial stress, and work-life balance. Give your clients the edge they need to support their employees while driving business growth. Download the report now to learn more!

Download Resource

Noom Health

From Noom Health

As obesity rates rise, GLP-1 medications are gaining popularity. Yet, the multifactorial obesity epidemic presents challenges for organizations as more employees seek GLP-1’s. This white paper explores actionable strategies to help cut costs, improve employee health outcomes, and achieve a measurable ROI.

Download Resource

ArmadaCare

From ArmadaCare

Are brokers prepared for what’s next? See the 5 hot benefits trends shaping 2025 in this report.

Download Resource

Optavise

From Optavise

Download this white paper to explore how voluntary benefits serve as crucial risk management tools for employers, mitigating the financial burden of workers’ compensation.

Download ResourceBenefitsPRO

Don’t miss crucial news and insights you need to navigate the shifting employee benefits industry. Join BenefitsPRO.com now!

- Unlimited access to BenefitsPRO.com - your roadmap to thriving in a disrupted environment

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

- Exclusive discounts on BenefitsPRO.com and ALM events

Already have an account? Sign In Now