Filter this View

- Benefits Broker

- Benefits Manager

- Retirement Advisor

- Awards

- Broker Expo

- FreeERISA

- Leads

- Career Center

- More

NOT FOR REPRINT

Page Printed from: benefitspro.com/search/?cmd=Search&page=3&search=%20medicaid%20enrollment

Search Results

Resources

Optavise

From Optavise

Download this white paper to explore how voluntary benefits serve as crucial risk management tools for employers, mitigating the financial burden of workers’ compensation.

Download Resource

ArmadaCare

From ArmadaCare

Help your clients make informed decisions about executive medical reimbursement plans while ensuring compliance amidst evolving regulations.

Download Resource

New Benefits

From New Benefits

Explore four strategies that benefits advisors can leverage to help their clients reduce healthcare expenses.

Download Resource

Nova Healthcare Administrators, Inc.

From Nova Healthcare Administrators, Inc.

Guiding your clients to the right network solution is vital for balancing costs, access, and employee satisfaction. Use this eBook as a strategic and educational tool to provide clarity for your clients around the ins and outs of network solutions.

Download Resource

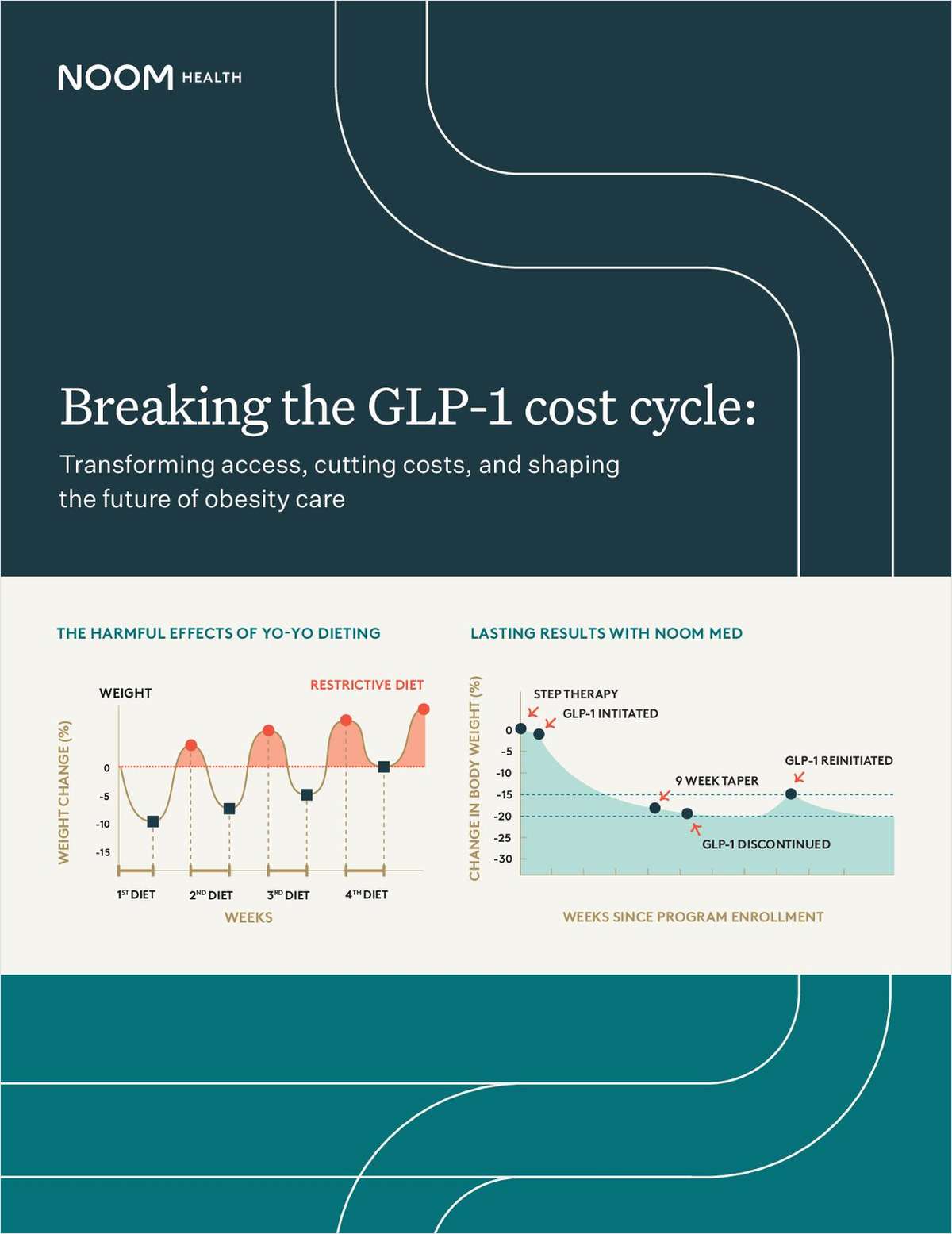

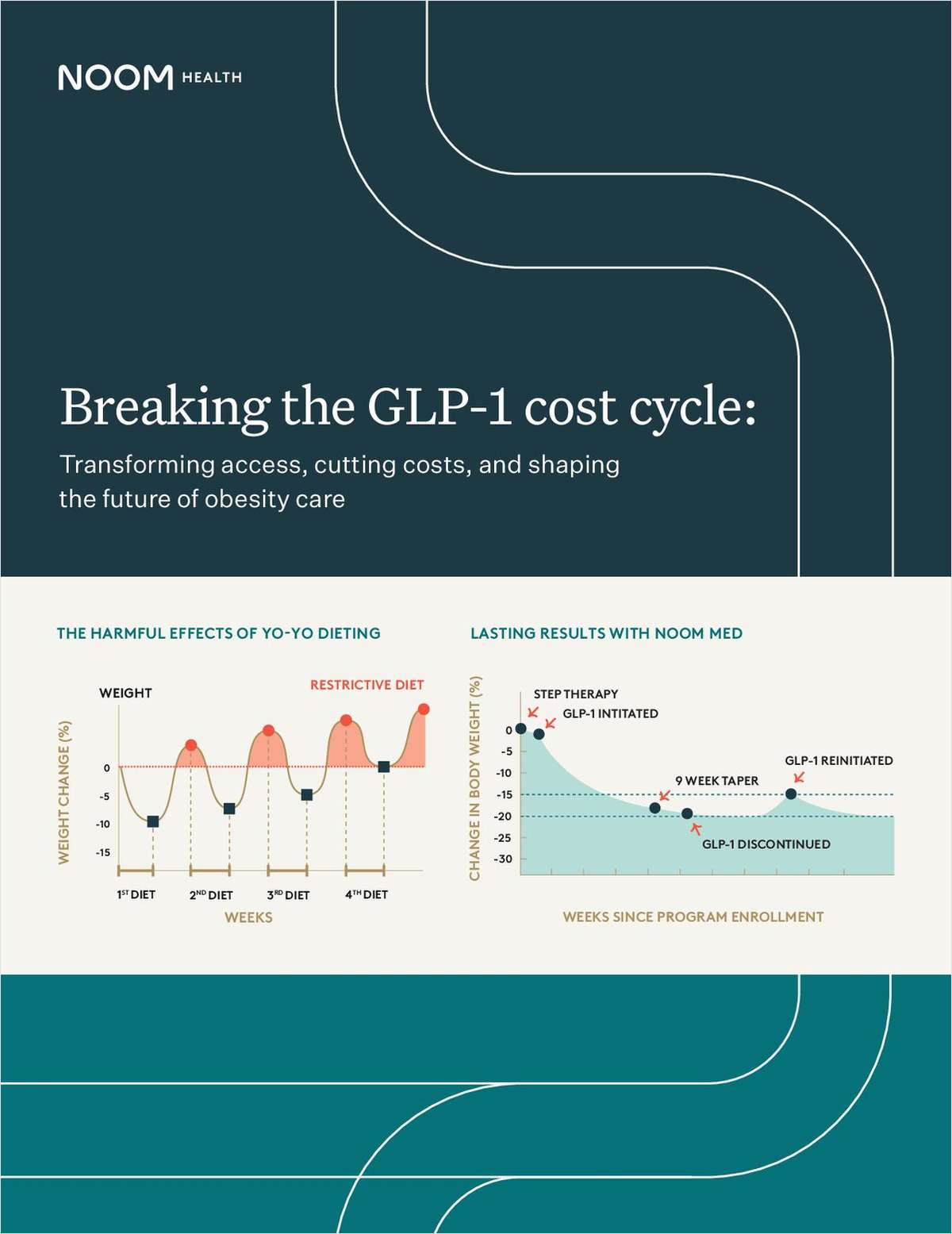

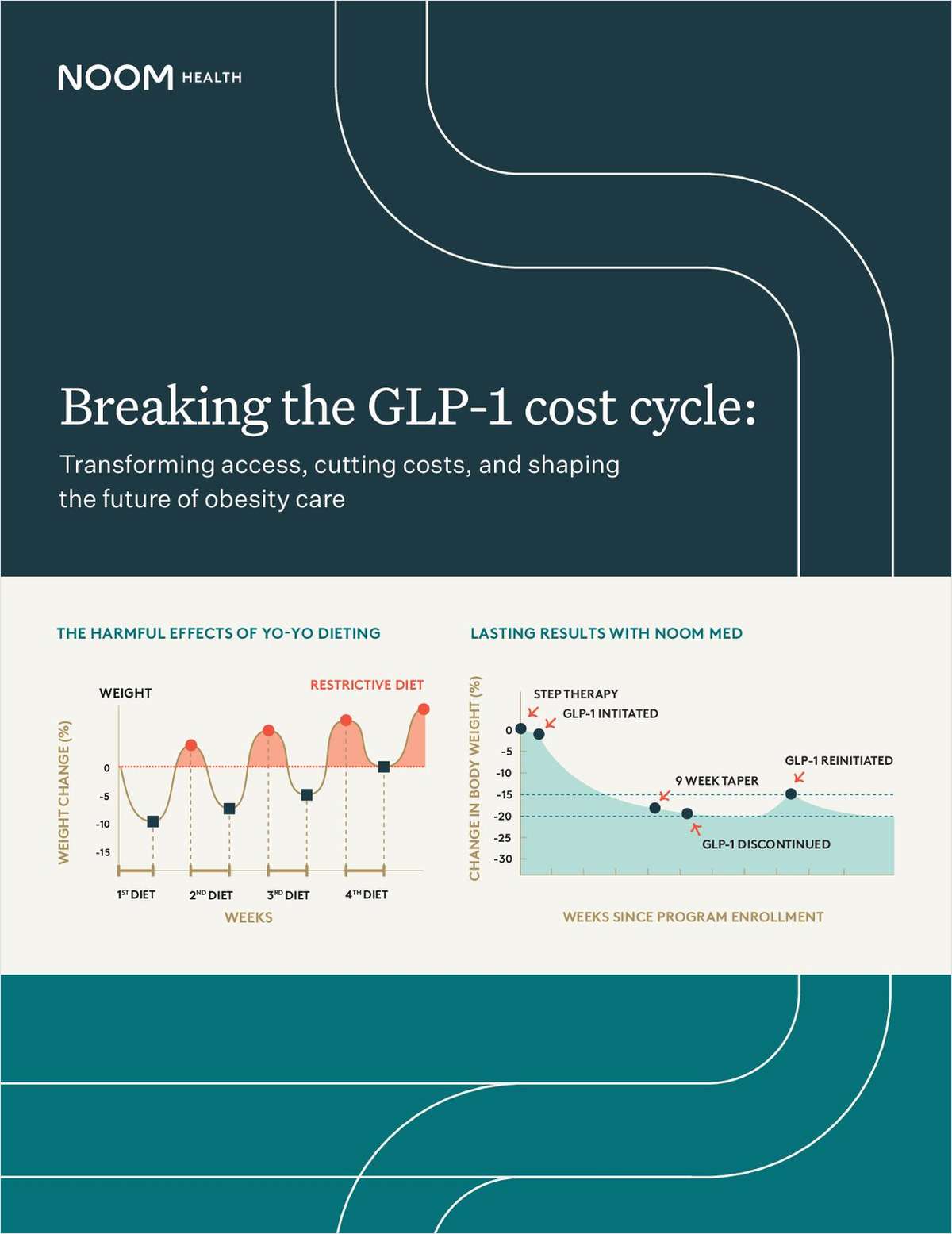

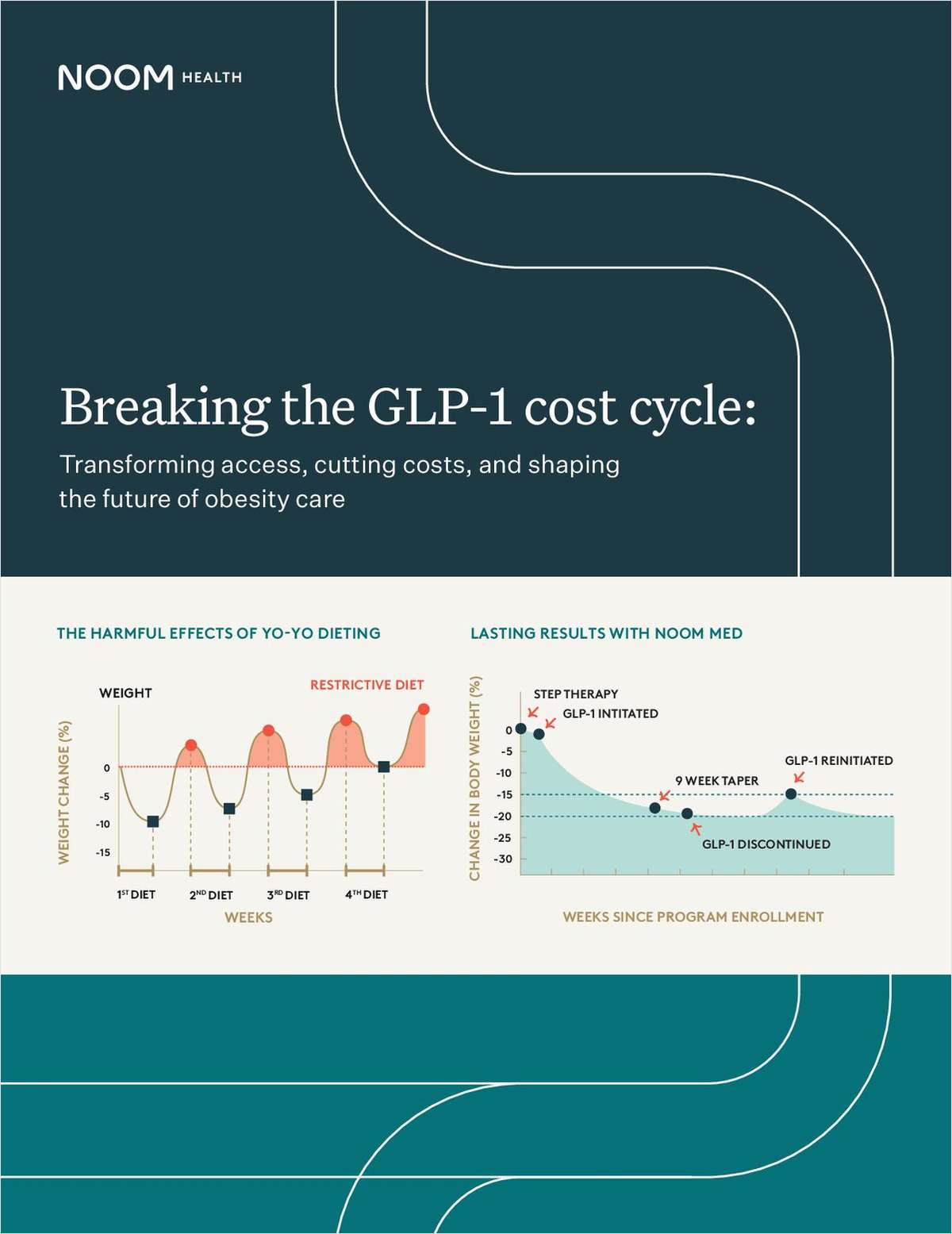

Noom Health

From Noom Health

As obesity rates rise, GLP-1 medications are gaining popularity. Yet, the multifactorial obesity epidemic presents challenges for your clients as more of their employees demand GLP-1’s. This white paper explores strategies to help clients cut costs, improve employee health outcomes, and achieve a measurable ROI.

Download Resource

New Benefits

From New Benefits

This report reveals the top non-insured benefits that not only reduce costs but also address the rising challenges of burnout, financial stress, and work-life balance. Give your clients the edge they need to support their employees while driving business growth. Download the report now to learn more!

Download Resource

Noom Health

From Noom Health

As obesity rates rise, GLP-1 medications are gaining popularity. Yet, the multifactorial obesity epidemic presents challenges for organizations as more employees seek GLP-1’s. This white paper explores actionable strategies to help cut costs, improve employee health outcomes, and achieve a measurable ROI.

Download Resource

SwellSpace

From SwellSpace

It’s no secret, Artificial Intelligence (AI) is a transformational force. And it’s already reshaping HR. Explore the ways AI is revolutionizing HR and practical strategies to make your team more strategic and engaging.

Download Resource

ArmadaCare

From ArmadaCare

Are brokers prepared for what’s next? See the 5 hot benefits trends shaping 2025 in this report.

Download Resource

SwellSpace

From SwellSpace

AI isn’t just poised to reshape workflows for benefit brokers - it already is. This paper explores why AI is a force multiplier for benefits advisors, and how it can increase your profits while enabling more personalized outcomes for clients.

Download Resource

SwellSpace

From SwellSpace

Discover detailed strategies for creating compelling content that engages employees across generations and drives positive outcomes for your organization. By understanding generational communication preferences, HR can develop tailored strategies that engage each group effectively, helping them make the best benefits choices.

Download Resource

Ivím at Work

From Ivím at Work

As obesity rates soar and new treatments like GLP-1s emerge, understanding your coverage options has never been more critical. This guide can help you navigate the complexities of obesity treatment to find an effective, sustainable solution for your workforce.

Download Resource

SwellSpace

From SwellSpace

Amidst rising healthcare costs and evolving employee expectations,discover how to distinguish yourself in a crowded market, retain clients, and grow your business by meeting the challenges employers face today. Get actionable strategies in this white paper.

Download Resource

Ivím at Work

From Ivím at Work

As obesity rates soar and new treatments like GLP-1s emerge, understanding coverage options has never been more critical. This guide can help you navigate the complexities of obesity treatment to find an effective, sustainable solution for your clients.

Download Resource

Optavise

From Optavise

Download this white paper to explore how voluntary benefits serve as crucial risk management tools for employers, mitigating the financial burden of workers’ compensation.

Download Resource

ArmadaCare

From ArmadaCare

Help your clients make informed decisions about executive medical reimbursement plans while ensuring compliance amidst evolving regulations.

Download Resource

New Benefits

From New Benefits

Explore four strategies that benefits advisors can leverage to help their clients reduce healthcare expenses.

Download Resource

Nova Healthcare Administrators, Inc.

From Nova Healthcare Administrators, Inc.

Guiding your clients to the right network solution is vital for balancing costs, access, and employee satisfaction. Use this eBook as a strategic and educational tool to provide clarity for your clients around the ins and outs of network solutions.

Download Resource

Noom Health

From Noom Health

As obesity rates rise, GLP-1 medications are gaining popularity. Yet, the multifactorial obesity epidemic presents challenges for your clients as more of their employees demand GLP-1’s. This white paper explores strategies to help clients cut costs, improve employee health outcomes, and achieve a measurable ROI.

Download Resource

New Benefits

From New Benefits

This report reveals the top non-insured benefits that not only reduce costs but also address the rising challenges of burnout, financial stress, and work-life balance. Give your clients the edge they need to support their employees while driving business growth. Download the report now to learn more!

Download Resource

Noom Health

From Noom Health

As obesity rates rise, GLP-1 medications are gaining popularity. Yet, the multifactorial obesity epidemic presents challenges for organizations as more employees seek GLP-1’s. This white paper explores actionable strategies to help cut costs, improve employee health outcomes, and achieve a measurable ROI.

Download Resource

SwellSpace

From SwellSpace

It’s no secret, Artificial Intelligence (AI) is a transformational force. And it’s already reshaping HR. Explore the ways AI is revolutionizing HR and practical strategies to make your team more strategic and engaging.

Download Resource

ArmadaCare

From ArmadaCare

Are brokers prepared for what’s next? See the 5 hot benefits trends shaping 2025 in this report.

Download Resource

SwellSpace

From SwellSpace

AI isn’t just poised to reshape workflows for benefit brokers - it already is. This paper explores why AI is a force multiplier for benefits advisors, and how it can increase your profits while enabling more personalized outcomes for clients.

Download Resource

SwellSpace

From SwellSpace

Discover detailed strategies for creating compelling content that engages employees across generations and drives positive outcomes for your organization. By understanding generational communication preferences, HR can develop tailored strategies that engage each group effectively, helping them make the best benefits choices.

Download Resource

Ivím at Work

From Ivím at Work

As obesity rates soar and new treatments like GLP-1s emerge, understanding your coverage options has never been more critical. This guide can help you navigate the complexities of obesity treatment to find an effective, sustainable solution for your workforce.

Download Resource

SwellSpace

From SwellSpace

Amidst rising healthcare costs and evolving employee expectations,discover how to distinguish yourself in a crowded market, retain clients, and grow your business by meeting the challenges employers face today. Get actionable strategies in this white paper.

Download Resource

Ivím at Work

From Ivím at Work

As obesity rates soar and new treatments like GLP-1s emerge, understanding coverage options has never been more critical. This guide can help you navigate the complexities of obesity treatment to find an effective, sustainable solution for your clients.

Download Resource

Optavise

From Optavise

Download this white paper to explore how voluntary benefits serve as crucial risk management tools for employers, mitigating the financial burden of workers’ compensation.

Download ResourceBenefitsPRO

Don’t miss crucial news and insights you need to navigate the shifting employee benefits industry. Join BenefitsPRO.com now!

- Unlimited access to BenefitsPRO.com - your roadmap to thriving in a disrupted environment

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

- Exclusive discounts on BenefitsPRO.com and ALM events

Already have an account? Sign In Now